[ Today @ 02:45 PM ]: Reality Tea

[ Today @ 02:42 PM ]: Yahoo Finance

[ Today @ 02:41 PM ]: The New Republic

[ Today @ 02:23 PM ]: CNN

[ Today @ 02:22 PM ]: sportskeeda.com

[ Today @ 02:21 PM ]: abc7NY

[ Today @ 02:04 PM ]: Kyiv Independent

[ Today @ 02:03 PM ]: WKBN Youngstown

[ Today @ 02:02 PM ]: Patch

[ Today @ 01:52 PM ]: Mid Day

[ Today @ 01:30 PM ]: KFYR TV

[ Today @ 01:28 PM ]: Mid Day

[ Today @ 01:23 PM ]: Financial Post

[ Today @ 01:02 PM ]: The Daily News Online

[ Today @ 12:22 PM ]: ESPN

[ Today @ 12:21 PM ]: Newsweek

[ Today @ 12:10 PM ]: NOLA.com

[ Today @ 12:07 PM ]: Daily Express

[ Today @ 12:06 PM ]: TheWrap

[ Today @ 12:06 PM ]: Rolling Stone

[ Today @ 12:05 PM ]: Radio Times

[ Today @ 12:04 PM ]: newsbytesapp.com

[ Today @ 12:03 PM ]: The Telegraph

[ Today @ 12:02 PM ]: NewsNation

[ Today @ 12:01 PM ]: reuters.com

[ Today @ 11:41 AM ]: Patch

[ Today @ 11:22 AM ]: Sports Illustrated

[ Today @ 11:22 AM ]: TechCrunch

[ Today @ 11:21 AM ]: wjla

[ Today @ 11:21 AM ]: Seeking Alpha

[ Today @ 11:06 AM ]: Bring Me the News

[ Today @ 10:46 AM ]: Boston Herald

[ Today @ 10:44 AM ]: WGME

[ Today @ 10:42 AM ]: The Straits Times

[ Today @ 10:32 AM ]: The Independent

[ Today @ 10:31 AM ]: yahoo.com

[ Today @ 10:30 AM ]: The New York Times

[ Today @ 10:22 AM ]: Channel NewsAsia Singapore

[ Today @ 10:12 AM ]: news4sanantonio

[ Today @ 10:08 AM ]: The Hill

[ Today @ 10:08 AM ]: Oregon Capital Chronicle

[ Today @ 10:07 AM ]: Fox Sports

[ Today @ 10:05 AM ]: Seeking Alpha

[ Today @ 10:05 AM ]: USA TODAY

[ Today @ 10:05 AM ]: Playmakerstats

[ Today @ 10:04 AM ]: ABC Kcrg 9

[ Today @ 10:03 AM ]: Tampa Free Press

[ Today @ 10:02 AM ]: NOLA.com

[ Today @ 10:02 AM ]: Associated Press

[ Today @ 10:00 AM ]: Athlon Sports

[ Today @ 09:46 AM ]: The Straits Times

[ Today @ 09:30 AM ]: NBC 6 South Florida

[ Today @ 09:28 AM ]: AeroTime

[ Today @ 09:22 AM ]: Oregonian

[ Today @ 09:21 AM ]: 24/7 Wall St

[ Today @ 09:01 AM ]: breitbart.com

[ Today @ 08:51 AM ]: PBS

[ Today @ 08:51 AM ]: wtvr

[ Today @ 08:50 AM ]: FanSided

[ Today @ 08:49 AM ]: NBC News

[ Today @ 08:48 AM ]: Newsweek

[ Today @ 08:47 AM ]: CNN

[ Today @ 08:46 AM ]: The Week

[ Today @ 08:45 AM ]: NBC Sports

[ Today @ 08:42 AM ]: gulfcoastnewsnow.com

[ Today @ 08:05 AM ]: Anfield Watch

[ Today @ 08:04 AM ]: What To Watch

[ Today @ 08:04 AM ]: Athlon Sports

[ Today @ 08:03 AM ]: GovCon Wire

[ Today @ 08:03 AM ]: Chargers Wire

[ Today @ 08:02 AM ]: WSB Radio

[ Today @ 08:01 AM ]: gadgets360

[ Today @ 07:49 AM ]: fox17online

[ Today @ 07:48 AM ]: The Boston Globe

[ Today @ 07:32 AM ]: Phys.org

[ Today @ 07:12 AM ]: WXIX-TV

[ Today @ 07:10 AM ]: KTAB Abilene

[ Today @ 07:09 AM ]: BBC

[ Today @ 07:08 AM ]: New Jersey Monitor

[ Today @ 07:07 AM ]: Press-Republican, Plattsburgh, N.Y.

[ Today @ 06:43 AM ]: Palm Beach Post

[ Today @ 06:03 AM ]: The Financial Times

[ Today @ 05:52 AM ]: SB Nation

[ Today @ 05:43 AM ]: Daily Mail

[ Today @ 05:41 AM ]: Reuters

[ Today @ 05:41 AM ]: Hartford Courant

[ Today @ 05:27 AM ]: Paul Tan

[ Today @ 05:22 AM ]: BBC

[ Today @ 05:21 AM ]: Journal Star

[ Today @ 05:21 AM ]: The Hans India

[ Today @ 04:31 AM ]: Push Square

[ Today @ 04:12 AM ]: Music Feeds

[ Today @ 04:11 AM ]: Sporting News

[ Today @ 04:10 AM ]: The Hockey News - Boston Bruins

[ Today @ 04:04 AM ]: Radio Times

[ Today @ 03:53 AM ]: The Financial Express

[ Today @ 03:51 AM ]: Variety

[ Today @ 03:51 AM ]: KOB 4

[ Today @ 03:50 AM ]: yahoo.com

[ Today @ 03:50 AM ]: Mickey Visit

[ Today @ 03:49 AM ]: The Telegraph

[ Today @ 03:47 AM ]: The New York Times

[ Today @ 03:42 AM ]: Channel NewsAsia Singapore

[ Today @ 03:13 AM ]: Cruise Industry News

[ Today @ 03:12 AM ]: Deseret News

[ Today @ 03:12 AM ]: WCAX3

[ Today @ 03:11 AM ]: Adweek

[ Today @ 03:08 AM ]: St. Joseph News-Press, Mo.

[ Today @ 03:08 AM ]: Pioneer Press, St. Paul, Minn.

[ Today @ 03:07 AM ]: WTNH Hartford

[ Today @ 03:06 AM ]: Associated Press

[ Today @ 03:05 AM ]: SB Nation

[ Today @ 03:04 AM ]: Sports Illustrated

[ Today @ 03:03 AM ]: Sporting News

[ Today @ 03:03 AM ]: MassLive

[ Today @ 03:02 AM ]: The Independent

[ Today @ 02:25 AM ]: NBC Chicago

[ Today @ 02:25 AM ]: Fox News

[ Today @ 02:24 AM ]: CBS News

[ Today @ 02:24 AM ]: The Cool Down

[ Today @ 02:22 AM ]: The Cincinnati Enquirer

[ Today @ 01:22 AM ]: Fox News

[ Today @ 01:09 AM ]: Paulick Report

[ Today @ 12:46 AM ]: The Cool Down

[ Today @ 12:43 AM ]: MLive

[ Today @ 12:41 AM ]: WTOP News

[ Today @ 12:29 AM ]: The 74

[ Today @ 12:28 AM ]: The Financial Times

[ Yesterday Evening ]: WSB Cox articles

[ Yesterday Evening ]: Medscape

[ Yesterday Evening ]: GamesRadar+

[ Yesterday Evening ]: Patch

[ Yesterday Evening ]: nbcnews.com

[ Yesterday Evening ]: Commanders Wire

[ Yesterday Evening ]: The New York Times

[ Yesterday Evening ]: WMUR

[ Yesterday Evening ]: Athlon Sports

[ Yesterday Evening ]: Mid Day

[ Yesterday Evening ]: The New Indian Express

[ Yesterday Evening ]: yahoo.com

[ Yesterday Evening ]: ABC Kcrg 9

[ Yesterday Evening ]: 24/7 Wall St.

[ Yesterday Evening ]: United Press International

[ Yesterday Evening ]: IGN

[ Yesterday Evening ]: Forbes

[ Yesterday Evening ]: NBC 10 Philadelphia

[ Yesterday Evening ]: Parade

[ Yesterday Evening ]: Sports Illustrated

[ Yesterday Evening ]: SB Nation

[ Yesterday Evening ]: NOLA.com

[ Yesterday Evening ]: The Cool Down

[ Yesterday Evening ]: Palm Beach Post

[ Yesterday Evening ]: breitbart.com

[ Yesterday Evening ]: NY Post

[ Yesterday Evening ]: Time

[ Yesterday Evening ]: The Daily Caller

[ Yesterday Evening ]: al.com

[ Yesterday Evening ]: WESH

[ Yesterday Evening ]: KLAS articles

[ Yesterday Evening ]: Seeking Alpha

[ Yesterday Evening ]: The Daily Dot

[ Yesterday Evening ]: ESPN

[ Yesterday Evening ]: Wyoming News

[ Yesterday Evening ]: KREX articles

[ Yesterday Evening ]: The Hill

[ Yesterday Evening ]: The Oklahoman

[ Yesterday Evening ]: Sporting News

[ Yesterday Evening ]: The Kitchn

[ Yesterday Evening ]: Fox News

[ Yesterday Evening ]: WBOY Clarksburg

[ Yesterday Evening ]: WESH

[ Yesterday Evening ]: MyNewsLA

[ Yesterday Evening ]: WHIO

[ Yesterday Evening ]: Orlando Sentinel

[ Yesterday Evening ]: Ukrayinska Pravda

[ Yesterday Evening ]: WISN 12 NEWS

[ Yesterday Evening ]: New Hampshire Union Leader

[ Yesterday Afternoon ]: reuters.com

[ Yesterday Afternoon ]: Talksport

[ Yesterday Afternoon ]: Sporting News

[ Yesterday Afternoon ]: OneFootball

[ Yesterday Afternoon ]: Athlon Sports

[ Yesterday Afternoon ]: Reuters

[ Yesterday Afternoon ]: NBC Connecticut

[ Yesterday Afternoon ]: BBC

[ Yesterday Afternoon ]: yahoo.com

[ Yesterday Afternoon ]: WPIX New York City, NY

[ Yesterday Afternoon ]: BBC

[ Yesterday Afternoon ]: The Irish News

[ Yesterday Afternoon ]: Live Science

[ Yesterday Afternoon ]: The Oklahoman

[ Yesterday Afternoon ]: Orange County Register

[ Yesterday Afternoon ]: Seeking Alpha

[ Yesterday Afternoon ]: Parade

[ Yesterday Afternoon ]: The Raw Story

[ Yesterday Afternoon ]: WLOX

[ Yesterday Afternoon ]: KOAT Albuquerque

[ Yesterday Afternoon ]: WSMV

[ Yesterday Afternoon ]: The Verge

[ Yesterday Afternoon ]: Sports Illustrated

Rivian Automotive (NASDAQ: RIVN) Stock Price Prediction for 2025: Where Will It Be in 1 Year (July 16)

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Rivian stock has trended upward recently despite facing challenges. Here is a look at where the stock could be in a year.

- Click to Lock Slider

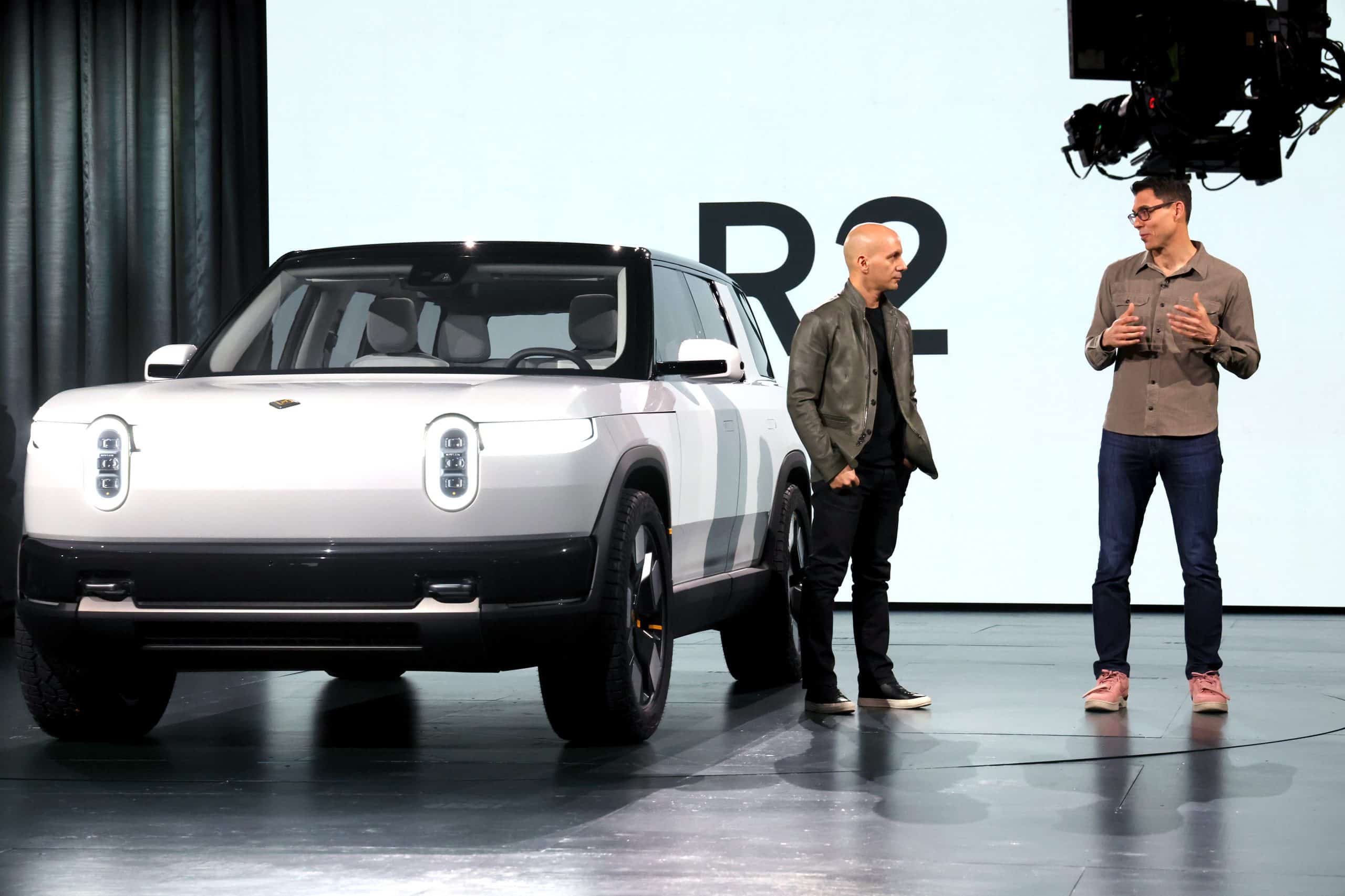

Rivian’s journey began with a strong vision to revolutionize the automotive industry by focusing on sustainable transportation. The company gained early attention for its R1T electric pickup truck and R1S SUV, both of which target the premium segment of the market with impressive range, performance, and off-road capabilities. Additionally, Rivian secured a major partnership with Amazon, which placed an order for 100,000 electric delivery vans to be delivered over the coming years. This deal not only provided Rivian with a significant revenue stream but also validated its technology and production capabilities in the eyes of investors. At its IPO, Rivian was valued at over $60 billion, reflecting high expectations for its growth potential in the rapidly expanding EV market.

However, the post-IPO period has been tumultuous for Rivian. Like many other EV startups, the company has struggled to scale production to meet demand. Early production hiccups, combined with global supply chain disruptions, led to delays in delivering vehicles to customers. These challenges were compounded by broader economic headwinds, including rising interest rates and inflation, which have dampened investor enthusiasm for high-growth, unprofitable companies. Rivian’s stock price, which soared to over $170 per share shortly after its IPO, plummeted in the subsequent months, reflecting concerns about its ability to execute on its ambitious plans. By mid-2024, the stock had lost a significant portion of its value, trading at levels far below its initial highs, as investors reassessed the risks associated with the company’s growth trajectory.

Despite these challenges, Rivian has made notable progress in addressing its operational hurdles. The company has ramped up production at its manufacturing facility in Normal, Illinois, and has begun delivering vehicles to both retail customers and Amazon. Rivian has also expanded its product lineup and introduced more affordable variants of its vehicles to appeal to a broader customer base. Furthermore, the company has secured additional funding and partnerships to support its long-term goals, including plans to build a second manufacturing plant in Georgia. These developments suggest that Rivian is taking steps to overcome its early struggles and position itself for sustainable growth in the competitive EV market.

Looking ahead to 2025, several factors will likely influence Rivian’s stock price trajectory. First and foremost is the company’s ability to scale production and meet delivery targets. If Rivian can consistently increase its output and fulfill its commitments to customers, including the large Amazon order, it could restore investor confidence and drive positive sentiment around the stock. Achieving production milestones would also help Rivian move closer to profitability, a critical factor for long-term success in the capital-intensive automotive industry. Currently, Rivian is operating at a loss as it invests heavily in research, development, and manufacturing capacity. Narrowing these losses and demonstrating a clear path to profitability will be essential for sustaining investor interest.

Another key factor is the broader EV market landscape. The industry is becoming increasingly competitive, with established automakers like Ford, General Motors, and Volkswagen ramping up their own EV offerings, alongside other startups vying for market share. Tesla, the dominant player in the space, continues to set the benchmark for innovation and scale. Rivian’s ability to differentiate itself through unique product features, brand loyalty, and strategic partnerships will be crucial in carving out a sustainable niche. Additionally, government policies and incentives for EV adoption, both in the United States and globally, could play a significant role in shaping demand for Rivian’s vehicles. Favorable regulations, such as tax credits for EV buyers or stricter emissions standards, could provide a tailwind for the company’s growth.

Macroeconomic conditions will also impact Rivian’s stock performance in 2025. The EV sector is particularly sensitive to interest rates, as higher borrowing costs can constrain consumer spending on big-ticket items like vehicles and limit access to capital for growth companies like Rivian. If inflationary pressures persist or if central banks maintain tight monetary policies, Rivian could face headwinds in attracting investment and sustaining its valuation. Conversely, an improving economic environment with lower interest rates and stronger consumer confidence could create a more favorable backdrop for the company’s stock to rebound.

Analyst sentiment and market expectations will further shape Rivian’s stock price in the coming year. While some analysts remain optimistic about Rivian’s long-term potential, citing its innovative products and strategic partnerships, others are more cautious due to the company’s ongoing losses and execution risks. Price targets for Rivian’s stock vary widely, reflecting the uncertainty surrounding its near-term performance. Investors will likely closely monitor Rivian’s quarterly earnings reports, production updates, and guidance for clues about its progress. Positive surprises, such as exceeding delivery targets or securing new contracts, could trigger upward momentum in the stock, while any setbacks could lead to further declines.

In terms of specific predictions for 2025, it is challenging to pinpoint an exact stock price given the volatility and uncertainty in the market. However, several scenarios are plausible based on Rivian’s current trajectory. In an optimistic scenario, if Rivian successfully scales production, narrows its losses, and capitalizes on growing EV demand, its stock could see a significant recovery, potentially trading at levels well above its mid-2024 price. This would likely be driven by renewed investor confidence in the company’s ability to execute and compete in the EV space. In a more conservative scenario, if Rivian continues to face production challenges or if macroeconomic conditions deteriorate, the stock could remain under pressure, trading within a lower range as investors adopt a wait-and-see approach. A bearish scenario, though less likely, could see further declines if Rivian encounters major setbacks, such as failing to meet key milestones or facing intensified competition that erodes its market position.

Beyond these scenarios, Rivian’s stock price in 2025 will also be influenced by broader market trends and investor sentiment toward growth stocks. The EV sector has experienced significant volatility in recent years, with valuations fluctuating based on hype cycles and economic conditions. Rivian, as a relatively young company with a limited track record, is particularly vulnerable to these swings. However, the company’s focus on sustainability and innovation aligns with long-term secular trends in the automotive industry, which could provide a foundation for growth over time.

In conclusion, Rivian Automotive’s stock price in 2025 will hinge on a combination of company-specific factors and external market dynamics. The company’s ability to scale production, achieve profitability, and differentiate itself in a crowded EV market will be critical to its success. While challenges remain, Rivian has shown resilience and progress in addressing its early struggles, and its strategic partnerships, particularly with Amazon, provide a strong foundation for growth. Investors considering Rivian stock should weigh the potential for significant upside against the risks of execution and market volatility. As the EV industry continues to evolve, Rivian’s performance over the next year will offer important insights into its long-term viability as a major player in the space. Whether the stock rebounds to new heights or remains under pressure will depend on how effectively Rivian navigates the opportunities and obstacles ahead.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/07/16/rivian-automotive-nasdaq-rivn-stock-price-prediction-for-2025-where-will-it-be-in-1-year/ ]

Similar Automotive and Transportation Publications