BYD Overtakes Tesla in Key European Markets

The Electric Shift: BYD Overtakes Tesla in Key European Markets, Signaling a Changing Landscape

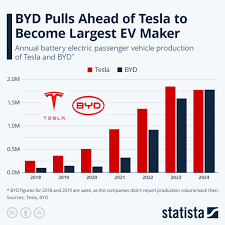

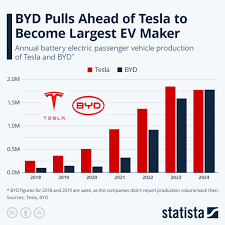

The electric vehicle (EV) landscape in Europe is undergoing a significant transformation, with Chinese automaker BYD rapidly gaining ground on industry leader Tesla. A recent report by Bloomberg reveals that BYD has surpassed Tesla in sales volume within both Germany and Norway – the two largest EV markets in Europe – marking a pivotal moment for the global automotive sector. This shift isn't just about numbers; it highlights changing consumer preferences, competitive pricing strategies, and the increasing influence of Chinese manufacturers on the European car market.

For years, Tesla has dominated the premium EV segment in Europe, building brand recognition and establishing charging infrastructure that initially gave them a considerable advantage. However, BYD’s aggressive expansion, coupled with its focus on affordability and increasingly sophisticated technology, is challenging this dominance. According to data cited by Bloomberg, BYD sold 16,408 vehicles in Germany during 2023, edging out Tesla's 15,978. In Norway, a country with exceptionally high EV adoption rates (over 80% of new car sales are electric), BYD’s performance was even more striking, selling 13,466 vehicles compared to Tesla’s 12,426.

The Keys to BYD's Success:

Several factors contribute to BYD’s impressive rise. Firstly, price point is a major differentiator. While Tesla continues to position itself as a premium brand with higher price tags, BYD offers a range of electric vehicles at significantly more accessible prices. This appeals to a broader consumer base, particularly in markets where government subsidies and incentives are crucial for EV adoption. The Atto 3 (Yuan Plus) compact SUV and the Dolphin hatchback have been particularly popular models, offering competitive features without the premium Tesla price tag. Bloomberg notes that BYD’s average transaction price is considerably lower than Tesla's, making them attractive to budget-conscious buyers.

Secondly, BYD’s vertical integration gives it a significant cost advantage. Unlike many automakers who rely on external suppliers for batteries and other key components, BYD manufactures its own battery packs (including the increasingly popular Blade Battery known for its safety and energy density) and electric motors. This control over the supply chain reduces costs and allows them to respond more quickly to market changes. The Blade Battery, in particular, has been a game-changer, contributing to improved vehicle range and enhanced safety performance – addressing concerns that have sometimes plagued early EV designs.

Thirdly, BYD’s rapid expansion of its dealer network is crucial for reaching European consumers. While Tesla initially relied heavily on direct sales through online platforms and company-owned stores, BYD has adopted a more traditional dealership model, partnering with established automotive distributors to gain wider market access. This allows them to leverage existing infrastructure and expertise in customer service and after-sales support.

Tesla's Response & the Broader Context:

While Tesla acknowledges the increased competition, they remain confident in their long-term strategy. Elon Musk has publicly commented on BYD’s success, acknowledging their competitive pricing but emphasizing Tesla’s ongoing investments in technology and autonomous driving capabilities. Tesla is currently focused on reducing production costs through initiatives like "Gigapressings" to streamline manufacturing processes (as detailed in a recent earnings call). They are also working on new, more affordable models to compete directly with BYD's offerings.

However, the challenge for Tesla extends beyond just price competition. The rise of BYD and other Chinese EV manufacturers – including Nio, Xpeng, and MG Motor – signals a broader shift in the global automotive landscape. China has become the world’s largest EV market, and its automakers are now aggressively expanding internationally, leveraging their technological advancements and cost advantages to gain market share.

Beyond Germany & Norway:

While BYD's success in Germany and Norway is significant, it doesn't necessarily guarantee similar results across all of Europe. Market preferences vary considerably from country to country. For example, the UK has a strong preference for SUVs, while other nations prioritize smaller city cars. However, BYD’s overall trajectory suggests that they are well-positioned to continue gaining market share in Europe. They have already announced plans to expand their presence into more European countries and introduce new models tailored to local preferences.

Looking Ahead:

The competition between Tesla and BYD is likely to intensify in the coming years. Tesla will need to address its pricing strategy and accelerate its efforts to reduce production costs, while BYD must continue to innovate and adapt to evolving consumer demands. The European EV market is becoming increasingly crowded, with established automakers also launching new electric models. Ultimately, the winners will be those who can offer compelling combinations of affordability, performance, technology, and brand appeal – a battle that promises to reshape the future of mobility in Europe and beyond. The Bloomberg report underscores that the era of unchallenged dominance for Tesla is over; the EV revolution is now truly global, and China is playing an increasingly pivotal role.

I hope this article provides a comprehensive summary of the Bloomberg piece and offers valuable context around the changing dynamics of the European EV market.

Read the Full Bloomberg L.P. Article at:

[ https://www.bloomberg.com/news/articles/2026-01-06/china-s-byd-outsells-tesla-in-europe-s-two-biggest-ev-markets ]