BYD Overtakes Tesla in Global EV Sales

BYD Overtakes Tesla: The Chinese Automotive Giant's Electric Vehicle Ascendancy

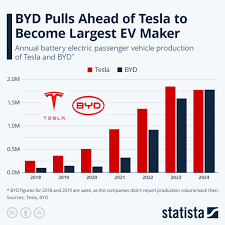

For years, Tesla has reigned as the undisputed king of the electric vehicle (EV) market. However, a seismic shift is underway. Chinese automotive giant BYD (Build Your Dreams) has officially surpassed Tesla in global EV sales, marking a significant moment in the automotive industry and signaling a potential reshaping of the electric vehicle landscape. The Sky News Australia article, and the underlying trend it highlights, reveals a complex story of rapid growth, strategic pricing, and a changing consumer landscape.

The core of the news lies in the latest sales figures. BYD delivered 943,342 electric vehicles in the first half of 2023, eclipsing Tesla’s 746,661. This isn’t simply a matter of a few thousand units; it represents a substantial lead and demonstrates BYD’s remarkable trajectory. While Tesla remains a dominant force, particularly in North America and Europe, BYD’s strength lies in its home market of China, the world’s largest EV market, and its expanding presence in Southeast Asia and other emerging regions.

The Chinese Advantage: Volume, Value, and Vertical Integration

BYD’s success isn't accidental. Several key factors contribute to its rapid rise. Firstly, China's government has been aggressively promoting electric vehicles through subsidies, tax breaks, and infrastructure development, creating a highly favorable environment for domestic manufacturers. This support has fueled a boom in EV adoption, and BYD is exceptionally well-positioned to capitalize on it.

Secondly, BYD’s pricing strategy has been a crucial differentiator. While Tesla has historically focused on the premium end of the market, BYD offers a wider range of vehicles, including more affordable options. The article highlights that BYD's vehicles often undercut Tesla's prices, making them accessible to a larger segment of the population. This focus on value is particularly appealing in price-sensitive markets. As reported by Reuters, BYD's average selling price was around $27,000 in the first half of 2023, significantly lower than Tesla’s average.

Crucially, BYD's vertically integrated business model provides a significant competitive advantage. Unlike Tesla, which relies heavily on external suppliers for components, BYD manufactures a vast array of its own parts, including batteries, electric motors, and semiconductors. This control over the supply chain reduces costs, mitigates risks associated with supply chain disruptions (a major issue for many automakers in recent years), and allows for greater flexibility in vehicle design and production. BYD’s battery technology, particularly its Blade Battery, has been lauded for its safety and cost-effectiveness, further bolstering its competitive edge. The Blade Battery, as detailed on BYD’s website, is designed for improved safety and energy density.

Tesla's Response and Future Outlook

Tesla isn't standing still. Elon Musk has acknowledged the increased competition and is actively working to maintain Tesla’s market share. The company is focused on expanding production capacity, particularly with its Gigafactory in Shanghai, and is reportedly considering price cuts to remain competitive. However, the price cuts, while potentially stimulating demand, also impact profit margins, a factor Tesla has been navigating carefully. The Sky News article mentions that Tesla's profit margins have been shrinking, a direct consequence of the price wars brewing in the EV sector.

Furthermore, Tesla is investing heavily in new technologies, including autonomous driving and energy storage solutions, to differentiate itself from competitors. The company's branding and reputation for innovation remain powerful assets, but BYD is rapidly closing the gap.

Beyond China: Global Expansion and Challenges

While China remains BYD’s stronghold, the company is aggressively expanding its global footprint. It's targeting markets in Southeast Asia, South America, and even Europe. However, expanding internationally presents its own set of challenges. BYD faces hurdles such as navigating different regulatory environments, establishing distribution networks, and building brand recognition in new markets. The article notes that BYD's expansion into Europe, while promising, will require significant investment and adaptation to local preferences.

The Broader Implications

BYD’s ascent has significant implications for the entire automotive industry. It demonstrates the increasing competitiveness of Chinese automakers and challenges the long-held dominance of Western brands. It also highlights the importance of vertical integration and strategic pricing in the EV market. The shift in the EV landscape isn't just about who sells the most cars; it's about the evolution of automotive technology, manufacturing processes, and the global distribution of power within the industry. The competition between BYD and Tesla is likely to intensify, driving innovation and ultimately benefiting consumers with more affordable and advanced electric vehicles. The ongoing price wars and technological advancements will undoubtedly shape the future of the automotive industry for years to come.

This summary aims to capture the key points of the Sky News article and provide additional context for understanding the significance of BYD’s rise.

Read the Full Sky News Australia Article at:

[ https://www.skynews.com.au/business/tech-and-innovation/chinese-automotive-giant-byd-passes-tesla-in-global-ev-race/news-story/c83ad97f89919a2386ef9ca3a89ead76 ]