India's Auto Industry Projected for Robust Growth Through 2026

RepublicWorld

RepublicWorld

India's Auto Industry Poised for Robust Growth: A Look at the 2026 Outlook

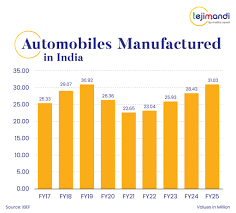

A recent report by CRISIL (formerly Credit Rating Information Services of India Limited) paints a decidedly optimistic picture for the Indian automobile industry, projecting significant growth across all major segments – two-wheelers (2W), three-wheelers (3W), passenger vehicles (PV), commercial vehicles (CV), and tractors – through 2026. The report, highlighted by Republic World, suggests that despite ongoing economic uncertainties and evolving consumer preferences, the Indian auto sector is well-positioned to capitalize on a confluence of factors driving demand.

Overall Growth Projections & Key Drivers:

The core takeaway from the CRISIL report is an anticipated compound annual growth rate (CAGR) of 8-10% for the overall automotive industry until fiscal year 2026-27. This robust growth isn't just a hopeful prediction; it’s underpinned by several key drivers. Firstly, India remains one of the fastest-growing major economies globally, leading to increased disposable incomes and a burgeoning middle class – prime consumers for automobiles. Secondly, government initiatives aimed at infrastructure development (roads, highways) are improving connectivity and facilitating vehicle usage. Thirdly, the increasing urbanization trend is creating greater demand for personal transportation solutions. Finally, the rising adoption of electric vehicles (EVs), while still in its nascent stages, is contributing to a shift in the market landscape and opening up new avenues for growth.

Segment-Specific Analysis:

Let's break down the projected performance across each segment:

- Two-Wheelers (2W): This remains the largest segment of the Indian auto industry, and CRISIL expects it to continue growing at a CAGR of 7-9%. The report highlights that rural demand will be crucial for this growth. While urban areas are seeing increased adoption of electric scooters, motorcycles remain dominant in rural markets due to their affordability and utility. Factors like rising fuel prices also contribute to the continued popularity of two-wheelers as an economical transportation option. The linked article from Motilal Oswal Financial Services reinforces this point, noting that 2W sales are closely tied to rural income levels and agricultural output.

- Three-Wheelers (3W): The three-wheeler segment is experiencing a particularly dynamic shift. The report anticipates a CAGR of 12-14%, driven largely by the transition towards electric three-wheelers. Government subsidies and incentives are accelerating this adoption, making EVs increasingly competitive with traditional internal combustion engine (ICE) models. The rise of ride-sharing services also fuels demand for three-wheelers, both ICE and EV variants. The shift to electric is not just about environmental concerns; it’s also driven by lower operating costs for drivers.

- Passenger Vehicles (PV): This segment has seen a resurgence in recent years, and the report projects a CAGR of 8-10%. The increasing preference for personal mobility post-pandemic, coupled with rising incomes and aspirations, is driving this growth. SUVs continue to dominate sales within the PV segment, reflecting changing consumer preferences towards larger, more feature-rich vehicles. While affordability remains a concern, financing options are making passenger vehicle ownership more accessible.

- Commercial Vehicles (CV): The commercial vehicle segment's performance is closely linked to economic activity and infrastructure development. CRISIL expects a CAGR of 9-11%, driven by increased freight movement and construction activities. The government’s focus on improving road infrastructure will further boost demand for CVs. Like three-wheelers, the electrification of commercial vehicles is also gaining traction, albeit at a slower pace due to higher upfront costs.

- Tractors: The tractor segment's growth (projected CAGR of 6-8%) is intrinsically tied to agricultural performance and rural income levels. While monsoon patterns and government support for agriculture play crucial roles, the increasing mechanization of farming practices continues to drive demand for tractors.

The Electric Vehicle Factor & Challenges Ahead:

The report acknowledges the growing importance of electric vehicles in shaping the future of the Indian auto industry. While EVs currently represent a small portion of overall sales, their share is expected to increase significantly by 2026. Government policies like FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) are instrumental in promoting EV adoption. However, challenges remain. High battery costs, limited charging infrastructure, and range anxiety continue to be barriers for widespread EV acceptance. The linked article from Icra highlights the dependence on imports for key EV components, particularly batteries, which poses a supply chain risk.

Supply Chain Considerations & Raw Material Costs:

The report also flags potential headwinds related to global supply chain disruptions and rising raw material costs. The ongoing semiconductor shortage has impacted vehicle production globally, including in India. Fluctuations in the prices of commodities like steel and aluminum can significantly impact manufacturing costs and potentially dampen profitability for automakers. CRISIL emphasizes that these factors could influence the pace of growth, although they are not expected to derail the overall positive outlook.

Conclusion:

The Indian automotive industry appears poised for a period of sustained growth through 2026. While challenges related to supply chains, raw material costs, and EV adoption remain, the underlying drivers – economic growth, infrastructure development, urbanization, and government support – are strong enough to propel the sector forward. The transition towards electric vehicles will be a defining feature of this period, reshaping the competitive landscape and creating new opportunities for innovation and investment. The report serves as a valuable roadmap for automakers, suppliers, and policymakers navigating the evolving dynamics of the Indian auto industry.

I hope this article provides a comprehensive summary of the Republic World report! Let me know if you'd like any adjustments or further elaboration on specific points.

Read the Full RepublicWorld Article at:

[ https://www.republicworld.com/automobile/auto-industry-outlook-2026-remains-optimistic-growth-seen-across-2w-3w-pv-cv-and-tractor-segments-report ]