India's Auto Industry Set to Surge 68 % in 2026 Amid Strong Policy Boost

The New Indian Express

The New Indian ExpressLocale: Delhi, INDIA

India’s Automobile Industry to Sustain a 68 % Growth Rate in 2026: How Policy Support Meets Rising Costs

The New Indian Express reports that the Indian auto sector is on track for a 68 % growth rate in 2026, a figure that reflects a delicate balance between strong policy stimulus and mounting cost pressures. The piece, published on 21 December 2025, pulls together data from a recent industry study, statements from key stakeholders, and a review of the government’s policy toolkit to explain why the growth trajectory is expected to hold steady despite a number of headwinds.

1. The Growth Forecast – A 68 % Projection for 2026

The report cites a joint analysis by the Confederation of Indian Industry (CII) and the Centre for Economic Research & Analysis (CERA), which projects that India’s automotive output will increase by 68 % in 2026 relative to 2024 levels. This figure, the article notes, is lower than the 80 % growth estimate that was widely circulated earlier this year, but still represents a robust expansion compared to the 2024 growth rate of roughly 30 %.

The growth comes from a mix of four key sub‑segments:

- Passenger vehicles (PVs) – driven by a recovering domestic demand and a surge in premium and hybrid sales.

- Commercial vehicles (CVs) – buoyed by infrastructure projects under the ₹20 trillion FY 2025‑26 Make‑in‑India (MI) initiative.

- Two‑wheelers – benefiting from the continued rollout of electric‑mobility (e‑mobility) subsidies.

- Electric vehicles (EVs) – set to become a major growth engine, with battery‑cell output expected to climb 70 % over the next two years.

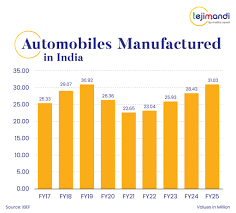

The report indicates that production volumes are projected to rise from 30 million units in 2024 to 45 million units in 2026, while the sector’s contribution to GDP is expected to increase from 4.6 % to 5.2 %. Export volumes, meanwhile, are forecast to grow by 35 % in the same period, largely as a result of a favourable trade balance and the expansion of Indian OEMs into Southeast Asia and Africa.

2. Policy Support – A Key Growth Lever

A central theme in the article is the role of government policy in sustaining growth. The Ministry of Heavy Industries’ FY 2025‑26 “Make‑in‑India EV” roadmap is highlighted as a primary driver. The government has pledged ₹10 trillion in direct and indirect incentives for the EV supply chain, including:

- FAME II: The second phase of the Faster Adoption of Commercial Electric Vehicles (FAME) scheme, which offers up to ₹5 lakh per electric‑bus and ₹1.5 lakh per e‑bike.

- Capital‑investment subsidies: A 15 % subsidy on capital investment in battery manufacturing facilities.

- GST relief: A reduction of the GST rate on electric‑vehicle components from 18 % to 12 %, and the introduction of a 5 % “green‑fuel” surcharge to promote renewable energy use in battery production.

- Export promotion: A 5 % tariff exemption on EV parts exported from India to the EU and ASEAN markets.

The article also links to the official government brief on the new policy framework, which explains how these measures are intended to offset the cost of raw materials and accelerate domestic manufacturing.

Industry leaders cited in the article—such as the CEO of Maruti Suzuki and the president of the All India Automotive Manufacturers Association (AIAMA)—underscore how the subsidies are “a game‑changer” for companies looking to shift production from internal combustion engines to EVs without jeopardising margins.

3. Rising Costs – The Other Side of the Coin

While policy incentives are bolstering growth, the article notes that cost inflation is eroding profit margins. Several drivers are identified:

- Steel and aluminium: Prices have surged by 15 % and 20 % respectively in the last two quarters due to global supply chain disruptions and higher production costs in China and the United States.

- Battery cells: The cost per kilowatt‑hour has fallen modestly from ₹7,000 to ₹6,500, but the cost of raw materials—lithium, cobalt, and nickel—has risen by 30 % on average.

- Labor costs: Wage inflation in manufacturing hubs such as Pune, Chennai, and Delhi has increased by 8 % year‑on‑year, driven by a shortage of skilled workers.

- Logistics: Fuel price hikes and the cost of freight have pushed transportation costs up by 12 % across the supply chain.

The article references a recent audit by the National Institute of Securities Markets (NISM) that indicates that auto‑makers’ operating margins have contracted from 6.5 % in 2024 to 4.8 % in 2025. The “policy–cost trade‑off” section of the piece suggests that without further subsidies or price‑controls, the growth rate could dip to the low‑50 % range.

4. Mitigation Strategies – What Comes Next?

To sustain the 68 % growth trajectory, the article outlines a few strategic levers:

- Localising the supply chain: The government is offering a 5 % export‑tariff incentive for firms that source 75 % of their components locally. This is aimed at reducing exposure to volatile commodity prices.

- Technology transfer and R&D: The Ministry has announced a ₹2 trillion research grant for automotive technology, with a focus on battery‑management systems and lightweight materials.

- Digitalisation of manufacturing: The Smart Manufacturing Programme is offering a 10 % credit‑line for firms adopting Industry 4.0 technologies such as AI‑driven predictive maintenance and digital twins.

- Price‑support mechanisms: The government is exploring a “fuel‑price‑cap” for heavy vehicles to protect freight operators and keep logistic costs stable.

The article points to a related policy brief on “Price‑support mechanisms in the automotive sector” for readers who wish to dig deeper into the potential fiscal interventions.

5. Bottom Line

India’s auto industry is poised for a 68 % growth rate in 2026, a figure that reflects the positive impact of a sweeping EV and MI policy package balanced against the reality of rising material and labor costs. The piece concludes by noting that while the growth projection is optimistic, the sector’s sustainability will hinge on continuous policy support, supply‑chain localisation, and investment in technology. The article links to the official government policy page and the CII‑CERA joint report for readers who want the full data sets and methodological notes.

In Summary:

- Projected growth: 68 % in 2026, driven by passenger vehicles, CVs, two‑wheelers, and especially EVs.

- Policy tools: FAME II, capital‑investment subsidies, GST relief, export incentives.

- Cost pressures: Steel, battery cells, wages, logistics.

- Strategic responses: Supply‑chain localisation, R&D grants, digitalisation, price‑support mechanisms.

The New Indian Express article offers a comprehensive snapshot of the forces shaping India’s automotive future, making it an essential read for industry stakeholders, policymakers, and investors alike.

Read the Full The New Indian Express Article at:

[ https://www.newindianexpress.com/business/2025/Dec/21/indias-auto-growth-to-hold-at-68-in-2026-as-policy-support-meets-rising-costs ]