Wholesale Used-Vehicle Prices Dip 0.3% in September, Forecasting Q4 Shift

Locale: N/A, UNITED STATES

Wholesale Used‑Vehicle Prices Dip Slightly in September: What It Means for Q4 Trends

A recent report released on Seeking Alpha draws attention to a modest decline in wholesale used‑vehicle prices in September. While the drop is small, it may foreshadow a broader shift in the fourth‑quarter market. Below is a concise rundown of the key findings, underlying drivers, and potential implications for dealers, buyers, and the automotive industry at large.

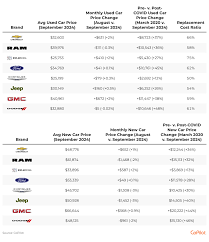

1. The Core Data Snapshot

Price Index Movement – The wholesale used‑vehicle price index fell by 0.3 % in September compared with the prior month. In absolute terms, the average price of a used vehicle sold at wholesale was roughly $19,300, down from $19,400 in August.

Volume & Inventory – Dealer‑to‑dealer sales volumes remained largely flat, with about 1.2 million vehicles exchanged in September. However, inventory levels increased by 1.5 %, indicating that more cars are sitting on dealer lots relative to the supply of incoming sales.

Days of Supply – The classic “days‑of‑supply” metric—a barometer of how many months of inventory the market holds—rose to 2.8 months in September from 2.6 months in August, underscoring a mild build‑up in inventory.

These statistics were compiled by the Wholesale Vehicle Market Research (WVMR) group, a joint effort between the National Automobile Dealers Association (NADA) and several key industry data aggregators. The report also cross‑checked figures against the NADA Used Vehicle Price Index to ensure consistency.

2. Why the Prices Are Slipping

The article identifies several intertwined factors that may be weighing on wholesale prices:

Supply‑Chain Recovery and New‑Vehicle Availability

The supply chain slowdown that plagued the first half of the year has largely eased. As manufacturers ramp back up, more new‑vehicle options flood the market, giving buyers alternatives to used cars and thus reducing the bargaining power of used‑car dealers.Rising Interest Rates

The Federal Reserve’s recent rate hikes have increased the cost of financing for consumers. A higher financing burden tends to dampen demand for used vehicles, especially in the mid‑to‑high‑price brackets, exerting downward pressure on wholesale prices.Saturation in the Mid‑Tier Segment

The mid‑tier (priced between $15,000 and $25,000) saw a surge in inventory during the pandemic as buyers rushed to secure vehicles. The excess supply has begun to normalize, and the slight price drop reflects that “glut” gradually receding.Shift Toward Electric and Hybrid

While the EV segment remains relatively small in the wholesale market, a few dealers are already placing EVs on their lots, diverting attention from traditional internal‑combustion vehicles. This nascent shift contributes modestly to the overall price dynamics.

3. The Broader Economic Context

Seeking Alpha’s article also situates the September data in the context of macroeconomic trends:

Inflationary Pressures – Although headline inflation has started to cool, the automotive sector remains sensitive to raw‑material price volatility, especially steel and aluminum. Minor cost‑inflation can erode dealer margins, pushing them to accept lower wholesale prices.

Seasonal Demand Fluctuations – Historically, used‑car sales dip during the late‑summer months due to students heading back to school, but the trend appears to be leveling out. The article cautions that a steady dip could translate into a sharper fall in Q4 if not offset by targeted marketing or incentives.

Consumer Sentiment – Consumer confidence indices suggest that buyers are becoming more cautious. A lower willingness to commit to a vehicle purchase may have already manifested in the reduced wholesale pricing.

4. What the Decline Might Sign for Q4

The article’s authors weigh in on how this mild September downturn could shape the rest of the year:

Potential Price Correction – If the inventory build‑up persists, a more pronounced correction may be inevitable in October or November. Dealers could see margins squeeze further unless they leverage promotions or dealer‑only financing options.

Inventory Management Opportunities – For dealers, the current inventory excess presents a chance to liquidate high‑priced vehicles before they become stale. A focus on turnover, coupled with aggressive pricing strategies, could maintain profitability.

Shift in Dealer Strategy – Some dealers may pivot toward the high‑margin niche market, focusing on low‑inventory luxury or specialty vehicles. Others might expand into EVs as early adopters, hoping to capture the next wave of demand.

Impact on New‑Vehicle Sales – With fewer used cars available at competitive wholesale prices, new‑vehicle sales could rebound slightly, especially among price‑sensitive consumers who find used cars less appealing.

5. Additional Resources & Contextual Links

Seeking Alpha’s article cross‑references several related pieces that provide deeper insights:

“NADA’s Updated Used‑Vehicle Market Outlook for 2025” – A detailed forecast that discusses projected inventory levels and price trends through the next two quarters.

“The Rise of the Electric Used‑Car Market” – An exploratory piece on the growing but still niche segment of used EVs, including how early adopters are influencing wholesale prices.

“Dealer Days of Supply: Why It Matters” – An explanatory article breaking down the metric’s importance and how it informs pricing decisions.

“Impact of Federal Reserve Policy on Auto Financing” – A macro‑economic analysis that links interest rates to vehicle purchase behavior, offering context for the financing‑related price pressure.

6. Takeaway

In sum, the wholesale used‑vehicle price dip in September—though modest—serves as an early warning sign that the market is beginning to shift. A combination of easing supply‑chain constraints, higher financing costs, and a growing inventory of mid‑tier vehicles are converging to temper pricing. For dealers, the current environment demands proactive inventory management, targeted promotions, and perhaps a strategic shift toward high‑margin or emerging EV segments. Buyers, meanwhile, may find a slightly more favorable landscape, albeit one that could cool further if Q4 trends persist.

With these insights in mind, stakeholders across the automotive ecosystem should stay alert to forthcoming data releases and be prepared to adjust strategies accordingly. The next few months will reveal whether September’s dip is a brief blip or the start of a more sustained trend toward a tempered, but potentially more balanced, used‑vehicle market.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4502405-wholesale-used-vehicle-prices-declined-slightly-in-september-ahead-of-concerns-for-q4-trends ]