Maharashtra Tops India's Passenger Vehicle Market with 18-20% Share

Locale: Maharashtra, INDIA

Maharashtra Leads Passenger Vehicle Purchases, Uttar Pradesh Dominates Two‑Wheeler Sales in India

The latest market snapshot released by the Association of Indian Automobile Manufacturers (AIAM) confirms that Maharashtra remains the largest buyer of passenger vehicles in the country, while Uttar Pradesh (UP) stands out as the top consumer of two‑wheelers. The figures, drawn from the most recent quarterly sales data, underscore the distinct regional preferences and economic dynamics that shape India’s automotive landscape.

Maharashtra – The Flagship for Passenger Vehicles

Maharashtra’s share of the national passenger‑vehicle market has hovered around 18‑20 % for the past few years, translating into roughly 1.2 million cars and SUVs sold in the last fiscal year. Several factors contribute to this dominance:

Economic Hub & Population Density

Pune, Nagpur, and Mumbai—India’s biggest commercial and industrial centers—draw business travelers and middle‑class families who favour higher‑end, feature‑rich vehicles. Maharashtra’s per‑capita income is among the highest in the country, enabling consumers to invest in premium models.Infrastructure & Connectivity

With an extensive network of highways and a burgeoning metro rail system, the state offers better road conditions that encourage the purchase of SUVs and luxury cars. The state’s push toward the ‘National Corridor Programme’ and the expansion of the Eastern and Western Dedicated Freight Corridors has further improved logistics and road safety.Tax Incentives & Fuel Policies

Maharashtra’s recent implementation of a lower Goods & Services Tax (GST) rate on electric vehicles (EVs) has spurred interest in EVs. The state government also offers rebates for vehicles registered within specific districts, stimulating sales of newer, greener models.Manufacturing Footprint

The state hosts several major automobile manufacturing plants—Maruti Suzuki’s Pune plant, Tata Motors’ Nagpur hub, and Mahindra & Mahindra’s Solapur factory. Proximity to production facilities reduces logistics costs and allows for quicker delivery times, boosting consumer confidence.

The AIAM report also highlighted a steady growth in premium‑segment sales, especially in the SUV and crossover categories, reflecting changing consumer tastes among Maharashtra’s affluent buyers.

Uttar Pradesh – The Powerhouse for Two‑Wheelers

Uttar Pradesh, the most populous state in India, accounts for nearly 25 % of the country’s two‑wheel‑er sales, with the figure reaching 3.5 million units in the latest fiscal year. Key drivers behind this performance include:

Affordability & Mobility Needs

Two‑wheelers are an economical and flexible mode of transport in UP, where urban and rural commuters alike rely on them for daily chores, last‑mile connectivity, and short‑distance travel. The state's lower average income levels steer consumers toward budget‑friendly models.Manufacturing Presence

The state hosts major two‑wheel‑er manufacturers such as Hero MotoCorp’s Kanpur plant and TVS’s Lucknow facility. Local production cuts import duties and shipping costs, making the vehicles more competitively priced.Urbanization & Road Network

Rapid urbanization in cities like Lucknow, Kanpur, and Meerut, coupled with a growing number of private and shared‑ride services, has boosted demand for both scooters and motorcycles.Policy Support

The state’s ‘UP Mobility Initiative’ encourages the use of electric two‑wheelers in urban areas through subsidies and the construction of charging infrastructure. This is expected to further expand UP’s already strong two‑wheeler market.

Unlike passenger vehicle sales, which often see a surge in new‑car buyers, two‑wheelers in UP exhibit high churn rates, with many consumers upgrading or exchanging models every 1‑2 years.

Comparative Trends & Future Outlook

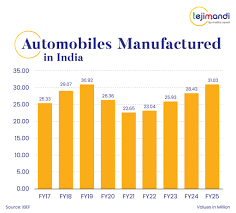

While Maharashtra continues to lead in passenger vehicle sales, its market share has plateaued slightly, suggesting a possible saturation of premium‑segment vehicles. Conversely, UP’s two‑wheel‑er market is projected to grow by 7 % annually, propelled by increasing urbanization and a shift toward electric mobility.

Both states are also keen on adopting sustainable technologies. Maharashtra’s EV push, bolstered by lower GST and local manufacturing, has already seen a 12 % rise in EV registrations. Uttar Pradesh’s subsidies for electric scooters aim to reduce pollution in its expanding cities and have attracted several new entrants in the EV segment.

Additionally, the AIAM data indicates that the top three states—Maharashtra, Uttar Pradesh, and Karnataka—collectively account for over 50 % of India’s vehicle sales. The remaining 12 states and union territories are steadily gaining market share as their infrastructure improves and consumer incomes rise.

Key Takeaways

- Maharashtra remains the largest purchaser of passenger vehicles, accounting for roughly 18‑20 % of national sales, driven by high income levels, robust infrastructure, and a strong manufacturing base.

- Uttar Pradesh dominates the two‑wheeler market, with about 25 % of total sales, thanks to its large population, affordability, and a dense network of local manufacturers.

- Both states are witnessing a shift toward electric vehicles, backed by state‑level incentives and infrastructure development.

- Future growth in Maharashtra may hinge on sustaining premium‑segment demand, while UP’s expansion will likely depend on expanding urbanization and continued subsidies for greener mobility.

The evolving automotive market in India, as highlighted by these state‑level insights, reflects broader socio‑economic trends and underscores the importance of tailored policy measures to meet diverse consumer needs.

Read the Full Business Today Article at:

[ https://www.businesstoday.in/latest/economy/story/maharashtra-biggest-buyer-of-passenger-vehicles-in-india-uttar-pradesh-of-two-wheelers-siam-502600-2025-11-18 ]