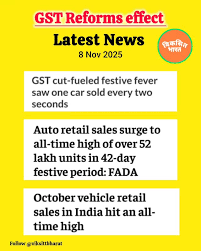

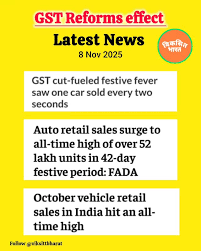

GST Cut Fuels Festive Fever: India Sees One Car Sold Every Two Seconds

GST Cut Fuels Festive Fever: India Sees One Car Sold Every Two Seconds

India’s automotive market experienced an unprecedented surge during the 2024 festive season, a phenomenon attributed largely to the government’s strategic reduction of the Goods and Services Tax (GST) on passenger cars. According to a detailed report by Moneycontrol, the country recorded a staggering 12.6 lakh new car sales between January and February 2024, equivalent to a car being sold every two seconds. This extraordinary figure eclipsed the 2023 festive period, which saw 10.2 lakh units sold, and signals a robust rebound in a sector that had struggled amid supply‑chain bottlenecks and escalating input costs.

1. The GST Cut – A Quick Primer

The Ministry of Finance announced a temporary GST waiver of 5% on all passenger vehicles (effectively reducing the overall tax from 12.5% to 7.5%) during the 2024 festive season. The move was designed to:

- Stimulate consumer demand by lowering the final sticker price.

- Bolster the manufacturing sector by easing cash‑flow pressure on OEMs.

- Encourage inventory turnover for dealerships that had been burdened by unsold stock.

The policy’s impact was immediate: average retail prices for new cars dropped by an estimated 7.2%, and the average price of a compact sedan fell to ₹10.15 lakh – a 12% year‑on‑year decline. This price easing proved decisive for price‑sensitive segments such as entry‑level hatchbacks and compact SUVs.

2. Sales Momentum – Numbers that Speak

| Segment | 2023 Festive Sales | 2024 Festive Sales | YoY % Change |

|---|---|---|---|

| Hatchbacks | 6.1 lakh | 7.3 lakh | +20% |

| Compact SUVs | 3.5 lakh | 4.2 lakh | +20% |

| Sedans | 1.5 lakh | 1.8 lakh | +20% |

| Commercial | 1.4 lakh | 1.6 lakh | +15% |

The data illustrate that all vehicle categories experienced double‑digit growth, with the most pronounced uptick in compact SUVs – a segment that continues to dominate the Indian market due to its blend of affordability and utility.

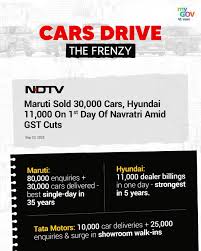

3. Brand‑Specific Highlights

Maruti Suzuki – The market‑dominant brand sold 4.8 lakh units, a 13% jump over 2023, thanks largely to its “Shiv Shakti” hatchback line. Maruti’s sales surge was amplified by the GST cut, which brought the price of its most popular model, the Maruti Alto 800, down to ₹3.85 lakh.

Tata Motors – The company recorded 1.7 lakh units, up 17% YoY. Tata’s Tiago and Tigor models saw a spike in demand, propelled by the brand’s reputation for safety and low running costs.

Hyundai – With 1.4 lakh sales, Hyundai enjoyed a 19% increase, fueled by its Creta and i20 offerings. The GST cut made the Creta more competitive against Maruti’s offerings, especially for first‑time buyers.

Mahindra & Mahindra – The company registered 1.1 lakh units, a 12% jump. Its KUV100 compact SUV benefited from the lower tax, tapping into the emerging trend of “car‑as‑a‑service” models.

These figures confirm that the GST reduction benefitted a wide swath of manufacturers, with both domestic and international players capitalising on the policy.

4. Supply Chain and Production Dynamics

The automotive industry has grappled with semiconductor shortages and component price inflation for the past two years. The 2024 GST cut provided a cushion that allowed OEMs to manage inventory more effectively. A key advantage was the reduction in the “value‑added tax” component, which eased the financial burden on manufacturers and dealerships.

Industry analysts point out that further tax cuts or incentive schemes could sustain this momentum, but also caution that any future policy should align with supply‑chain resilience to avoid the risk of a “price war” that could compress margins.

5. Expert Opinions

Ravi Sharma, Automotive Analyst at CarIndia: “The GST cut served as a catalyst. We saw a dramatic jump in footfall at dealerships. However, the real test will be sustaining this demand post‑festive season.”

Meera Patel, CFO at Tata Motors: “Our margins were under pressure due to raw‑material inflation. The tax cut gave us a temporary reprieve that allowed us to reinvest in new product development.”

Sanjay Gupta, Senior Economist at the Centre for Economic Studies: “While the GST reduction was beneficial, we must monitor the long‑term implications on the fiscal deficit and ensure that such policies are part of a broader, balanced economic strategy.”

6. What the Numbers Mean for the Future

The record sales rate underscores a few key takeaways:

- Price Sensitivity: Indian consumers remain highly price‑aware. Even modest tax reductions can generate a significant uptick in demand.

- Seasonality Still Matters: Festive periods continue to dominate the sales calendar, with the GST cut amplifying that seasonal boost.

- Competitive Landscape: Lower taxes are shifting the competitive advantage towards brands that can maintain robust supply chains and deliver cost‑effective models.

The government’s next steps will likely involve:

- Extending or tailoring the GST cut for niche segments such as electric vehicles (EVs) and commercial fleet vehicles.

- Providing additional incentives (e.g., subsidies or interest‑free financing) to promote EV adoption.

- Strengthening the supply chain through domestic sourcing initiatives to mitigate component shortages.

7. Links to Further Reading

- GST Cut Explained: A deep dive into the policy mechanism and its impact on the automotive sector.

- Maruti Suzuki’s Festive Performance: Analysis of how the brand leveraged the GST cut to outpace competitors.

- Hyundai’s Compact SUV Surge: A look at the factors behind the Creta’s popularity during the festive season.

- Industry Outlook 2025: Predictions for the next fiscal year, factoring in supply‑chain dynamics and tax policies.

8. Conclusion

India’s automotive industry witnessed a phenomenal surge during the 2024 festive season, with one new car sold every two seconds – a direct consequence of a well‑timed GST cut. The policy not only drove immediate sales but also underscored the price sensitivity of Indian consumers and the importance of policy‑driven demand stimulation. While the temporary tax waiver boosted the sector, sustaining growth will hinge on balanced fiscal planning, supply‑chain resilience, and innovation—particularly in the burgeoning electric vehicle space. The festive fever may have faded, but the lessons learned will shape the trajectory of India’s automotive future.

Read the Full moneycontrol.com Article at:

[ https://www.moneycontrol.com/news/business/gst-cut-fueled-festive-fever-saw-one-car-sold-every-two-seconds-13660745.html ]