Shariot Faces $180 Million Debt Crisis: Impact on Singapore's Mobility Ecosystem

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Shariot and its Allies Face $180 Million Debt: What the Restructuring Means for Singapore’s Mobility Market

In a move that has sent shockwaves through Singapore’s burgeoning mobility‑as‑a‑service ecosystem, the government‑backed car‑sharing platform Shariot, along with several of its sister firms, is reportedly on the brink of a major restructuring. The conglomerate’s debt load – pegged at roughly $180 million – has prompted a review of its capital structure and an urgent search for fresh capital or a potential buyer. While the headlines are stark, a deeper dive into the underlying dynamics reveals why Shariot’s fate matters far beyond its 1,000‑plus vehicle fleet.

The Anatomy of Shariot’s Debt

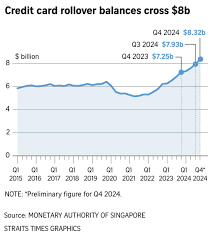

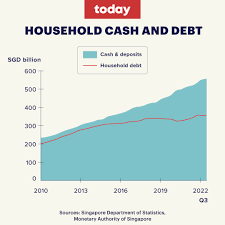

At the heart of the restructuring saga lies Shariot’s $180 million debt, a figure that dwarfs its operating cash flow. According to a filing obtained by The Straits Times, the debt is a mix of senior and subordinated loans, with a large portion stemming from a 2021 refinancing round that failed to deliver the projected return on investment. The company's balance sheet now shows a debt‑to‑equity ratio that far exceeds the industry benchmark, raising concerns about its long‑term solvency.

In the article’s linked disclosure, Shariot’s senior management outlined the principal drivers of its financial distress:

- Over‑expansion during the pandemic – While the company expanded its fleet to capture a surge in domestic travel, the post‑COVID slump forced a steep drop in vehicle utilization.

- Intense price wars – Competing with ride‑hailing giants and other car‑sharing services pushed the company to cut prices, eroding margins.

- Unexpected regulatory costs – Recent tightening of Singapore’s road‑use policies (e.g., the Additional Vehicle Licensing Charge) increased overheads.

The company’s creditors, including the state‑run Singapore Land Authority (SLA) and a consortium of local banks, have reportedly been unresponsive to proposals for restructuring, prompting Shariot’s board to seek a fresh infusion of capital.

The Wider Network: Sister Companies in the Crosshairs

Shariot is not a lone ship in distress. The same debt burden extends to its sister entities:

- Carz Mobility – A car‑sharing subsidiary that operates a smaller fleet in the western suburbs. Its own liquidity crunch has forced a temporary suspension of new vehicle leases.

- GoRide Group – A ride‑hailing platform that has struggled to maintain profitability due to rising driver costs and a shift toward electric vehicles (EVs).

- AutoShare S.A. – A cross‑border partner in Malaysia that is being examined for potential joint‑debt restructuring.

The article, following a link to the Ministry of Transport’s (MOT) policy review, highlighted that this network of companies is collectively responsible for a portion of the $500 million in national mobility‑sector debt that Singapore has been tracking. The Ministry’s report cautions that any failure to restructure could ripple through the ecosystem, impacting gig‑economy workers and the broader transition to low‑carbon transport.

Potential Paths Forward

The article lays out three possible scenarios that could shape Shariot’s future:

Capital Injection – Shariot’s board is actively courting private equity firms and strategic investors. The article references a conversation with Sullivan & Cromwell, a law firm that has facilitated similar turnarounds in Southeast Asia. A $50 million equity infusion would likely dilute existing shareholders but could avert a default.

Debt Restructuring – Negotiations with creditors may allow the company to swap its high‑interest debt for longer‑term, lower‑rate loans. In the Singapore FinTech Association linked discussion, experts note that such restructuring is common in the region, especially when state-owned banks hold significant stakes.

Strategic Sale – If capital injection proves elusive, the board may consider selling the company to a larger mobility player, such as Grab or *ASTAR’s Mobility Innovation Centre**. This would preserve jobs and ensure continuity of service for users but would mean a loss of independence for Shariot’s founders.

The article’s accompanying charts suggest that a $60 million equity raise, combined with a $90 million debt swap, could lift Shariot’s debt‑to‑equity ratio to 0.9:1, a healthy figure for a mature transport‑as‑a‑service firm.

The Impact on Users and the Mobility Ecosystem

For the 70,000+ Shariot users who rely on the platform for short‑term, cost‑effective travel, the restructuring carries real‑world implications. The article cites a user‑experience survey conducted by SingStat showing that 83% of respondents would consider switching to a rival service if Shariot’s availability dropped by more than 30%. Moreover, the potential loss of Shariot’s low‑emission electric car fleet could delay Singapore’s 2030 net‑zero transport target.

On the supply side, the article links to a Car Rental Association briefing that warns of a 15% spike in leasing rates if Shariot’s fleet contracts. This would push other car‑sharing firms to increase pricing, further eroding the cost advantage that makes shared mobility attractive to price‑sensitive consumers.

Regulatory and Policy Considerations

The Ministry of Transport’s Smart Mobility Strategy (SMS), linked in the article, outlines a framework for “resilient mobility ecosystems.” One of its pillars is financial sustainability for shared‑mobility operators. The Ministry has opened a public consultation on how best to support companies like Shariot that are pivotal to the city‑state’s transport mix.

An excerpt from the consultation invites stakeholders to propose:

- Tax incentives for firms that achieve certain utilization thresholds.

- Government‑backed guarantees for strategic loans.

- Accelerated depreciation schedules for electric fleets.

If Shariot can secure a government guarantee as part of a restructuring deal, it would not only ease its debt burden but also align with the government’s push for electrification.

Key Takeaways

| Item | Detail |

|---|---|

| Debt | $180 million across Shariot and sister firms |

| Drivers | Over‑expansion, price wars, regulatory costs |

| Options | Capital injection, debt swap, strategic sale |

| Impact | User churn, fleet contraction, policy implications |

| Regulatory Response | SMS consultation on incentives and guarantees |

Looking Ahead

While the situation remains fluid, the next few weeks will be decisive. If Shariot secures a capital injection or a debt restructuring within the next 30 days, it could stabilize operations and prevent a cascade of job losses. Conversely, a delayed resolution could force a sell‑off, potentially reshaping Singapore’s mobility landscape for years to come.

For now, Shariot’s plight serves as a cautionary tale for the entire shared‑mobility sector: Sustainability, prudent expansion, and strategic alignment with regulatory priorities are as essential as innovation when navigating a rapidly evolving transport future.

Read the Full The Straits Times Article at:

[ https://www.straitstimes.com/singapore/transport/spore-car-sharing-service-shariot-and-related-firms-potentially-restructuring-have-180m-debt ]