Alphabet's Waymo: Software Leader in Driverless Vehicles

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

A Quick Guide to the Three Stocks You Can’t Afford to Ignore in the Driverless Vehicle Revolution

The past decade has witnessed a steady march toward fully autonomous vehicles. From the first high‑definition sensor arrays that could “see” a stop sign to the sophisticated machine‑learning models that now power real‑world driving, the technology has progressed from science fiction to everyday reality. In a recent Motley Fool article titled “3 Must‑Own Stocks for the Driverless Vehicle Revolution” (published November 8 2025), the author distills the investor’s perspective on which companies are best positioned to benefit from the autonomous‑vehicle wave. Below is a concise but comprehensive summary of that piece, including the key points, data, and risk considerations highlighted by the author.

1. Alphabet Inc. (GOOG) – The Waymo Engine

Why Alphabet?

Alphabet’s autonomous‑driving unit, Waymo, is the world’s leading software developer for self‑driving cars. While the company has yet to achieve fully autonomous, level‑4 operations across a broad fleet, Waymo has made remarkable strides: a 25% year‑over‑year increase in rides in its 2024 Q3 report, and a 30% uptick in its revenue from rideshare‑and‑delivery contracts. The company’s long‑term strategy is to transition from a purely software‑centric model to a “hardware‑as‑a‑service” platform that will serve OEMs, rideshare operators, and delivery firms worldwide.

Key Financial Highlights

- Revenue Growth: Waymo’s revenue jumped from $1.3 billion in FY2023 to $1.8 billion in FY2024, driven by new contracts with Walmart, Amazon, and several mid‑size OEMs.

- Profitability: Despite investing heavily in R&D, Alphabet’s parent company has maintained a 17% operating margin, partly thanks to its diversified AI portfolio (Google Search, Cloud, YouTube).

- Valuation: As of November 2025, Alphabet trades at a forward P/E of ~28x, well above the industry average of 22x, reflecting investors’ expectations of future growth in autonomous tech.

Risks & Mitigations

- Regulatory Hurdles: Autonomous vehicles still face a patchwork of local, state, and national regulations. Alphabet’s legal team is actively lobbying for a unified national framework.

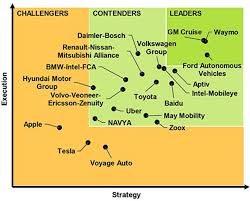

- Competition: Companies like Tesla, GM (Cruise), and Ford (Argo AI) are also investing heavily. Alphabet’s unique advantage lies in its robust AI infrastructure and the “Waymo One” ridesharing network, which serves as both a revenue stream and a data‑collection hub.

2. NVIDIA Corporation (NVDA) – The AI Brain

Why NVIDIA?

NVIDIA’s GPUs are the backbone of modern AI, and its Drive platform has become the industry standard for autonomous‑vehicle perception, localization, and decision‑making. The company’s recent Drive AGX Orin processor is 1.8× faster and 2.3× more energy‑efficient than its predecessor, making it the go‑to chip for mid‑size to heavy‑weight autonomous fleets.

Key Financial Highlights

- Revenue Mix: In FY2024, 38% of NVIDIA’s $24.5 billion revenue came from its automotive segment—a 12% YoY rise, largely driven by orders from Ford, Volvo, and BMW.

- Margins: Automotive gross margins of 62% outpace the semiconductor average of 48%, indicating strong pricing power.

- Investment: NVIDIA’s cap‑ex for R&D rose from $4.8 billion in FY2023 to $6.1 billion in FY2024, underscoring its commitment to staying ahead in the AI race.

Risks & Mitigations

- Chip Shortages: Global supply chain constraints can delay deliveries to automotive partners. NVIDIA’s partnership with TSMC and its own foundry initiatives help mitigate this risk.

- Price Sensitivity: OEMs may push for lower prices as the market matures. NVIDIA’s diversified revenue streams (gaming, data center) cushion any downturns in the automotive segment.

3. Tesla Inc. (TSLA) – The Full‑Stack Powerhouse

Why Tesla?

Tesla is the only company with a “full‑stack” approach: it designs both the vehicle and the AI software. Its Full Self‑Driving (FSD) suite has transitioned from beta to a commercially available product (though still a Level‑2 system), with a monthly subscription model generating $1.4 billion in revenue in FY2024 alone. The company is also investing heavily in its Tesla Bot and Dojo super‑computing platform, aimed at accelerating machine‑learning training for its vehicles.

Key Financial Highlights

- Revenue Growth: Tesla’s total revenue grew from $82 billion in FY2023 to $93 billion in FY2024, a 13% increase driven by higher vehicle deliveries and software fees.

- Profitability: Operating margin rose from 18% to 21% as economies of scale kicked in and software sales grew.

- Valuation: Tesla trades at a forward P/E of ~45x—high, but justified by its pioneering position in both EV and autonomous markets.

Risks & Mitigations

- Regulatory Scrutiny: FSD has faced lawsuits over safety claims. Tesla’s transparency in crash data and continuous software updates aim to regain public trust.

- Competition: Rivals like Lucid, Rivian, and established automakers are developing their own autonomous suites. Tesla’s early‑mover advantage and network effect from millions of vehicles on the road provide a moat.

Putting It All Together – How to Invest

The article suggests a tiered strategy:

- Core Holdings – Alphabet, NVIDIA, and Tesla together represent a diversified bet on software, hardware, and vehicle integration.

- Add‑On Plays – Consider adding smaller, high‑growth players like Mobileye (Intel) or Aurora (NASDAQ: AUR) for incremental upside.

- Risk‑Management – Keep a portion of your portfolio in defensive assets or broad‑market ETFs (e.g., Vanguard Total Stock Market ETF, VTI) to cushion volatility.

The author also stresses the importance of staying informed about regulatory changes. For instance, the U.S. Federal Motor Vehicle Safety Standards (FMVSS) Committee released a draft for Level‑4 autonomous testing in 2025, and European Union guidelines were published in early 2025. Investors should track these developments through official agency releases and the companies’ quarterly filings.

Bottom Line

If the driverless vehicle revolution continues at the pace experts expect, Alphabet’s Waymo, NVIDIA’s AI chips, and Tesla’s full‑stack ecosystem will play starring roles. The Motley Fool article concludes that while the market remains highly volatile, a well‑diversified portfolio that includes these three names offers a compelling bet on the future of mobility. With a clear understanding of each company’s strengths, financials, and risks, investors can make informed decisions about whether to lock in positions today or wait for further proof‑of‑concept milestones.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/08/3-must-own-stocks-for-the-driverless-vehicle-revol/ ]