South Korea Boosts EV Subsidies to 20% to Counter U.S. Trade Pressure

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

South Korea Boosts EV Subsidies to Counter U.S. Trade Pressure

South Korea has announced a substantial increase in government‑backed subsidies for electric vehicle (EV) purchases, a move that the Ministry of Economy and Finance says is designed to keep domestic automakers competitive amid growing U.S. trade tensions. The policy shift—set to take effect in late 2025—will see subsidies rise from the current 15 % of the purchase price to 20 %, with a new cap that will allow consumers to benefit from a maximum of roughly ₩5 million (about US$3,600) per vehicle. The plan is part of a broader “Green New Deal” strategy that aims to cut carbon emissions, boost the domestic EV market, and protect South Korea’s leading automakers—Hyundai, Kia, and the emerging electric‑only brands—from what Seoul perceives as an unfair competitive edge for American-made EVs.

The U.S. Trade Context

In the United States, the Inflation Reduction Act (IRA) introduced a tax‑credit program for electric vehicles that has been the subject of intense scrutiny. The program allows U.S. consumers to claim up to $7,500 in federal tax credit for eligible EVs, but the legislation also includes “source” rules that require a significant portion of a vehicle’s components—especially batteries—to be manufactured in North America. This has prompted a wave of trade disputes, with the U.S. Department of Commerce threatening to impose tariffs on imports that do not meet the domestic‑content thresholds.

South Korea’s government has warned that the new U.S. policy could lead to higher tariffs on Korean EVs if they are unable to satisfy the domestic‑content requirement. In particular, the Korean government has cited the U.S. “Section 232” tariff regime, which allows the U.S. to impose duties on imports that threaten national security or public health. While the Korean Ministry has not confirmed that any tariff will be levied against Korean EVs, the potential exists, and the Ministry’s decision to raise subsidies is an effort to blunt any negative effects.

How the Subsidy Upgrade Works

Under the current 15 % subsidy regime, South Korean consumers can receive up to 15 % of the purchase price of an EV in the form of a direct cash rebate or a credit to the car dealer. The new 20 % subsidy will be rolled out over a two‑year period, with the highest rates applied to the most expensive models. The Ministry has clarified that the subsidy will not apply to hybrid vehicles, which it views as a transitional technology. Instead, the focus is on fully electric models that meet specific emission thresholds.

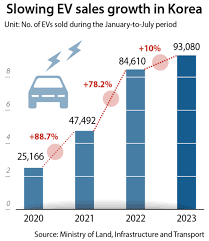

The increased subsidy is expected to drive a significant uptick in EV sales. According to data from the Korean Automotive Dealers’ Association, EV sales have been growing at a compound annual growth rate of 35 % over the past three years, but the share of EVs in total new‑car sales remains below 5 %. By raising the subsidy, the Ministry hopes to bring that figure up to 15 % by 2028.

Domestic Automaker Reactions

Hyundai Motor Group’s CFO, Kim Ji‑ha, said in a statement that the subsidy increase is “a positive signal that the government is committed to the long‑term competitiveness of the EV market.” He also noted that the group’s battery‑in‑house program will help reduce its reliance on imported battery cells, thereby avoiding potential U.S. tariff risk.

Kia Corp’s CEO, Sang‑woo Cho, highlighted the importance of the new subsidy in making EVs more affordable to the “average Korean family.” He emphasized that the company is expanding its EV lineup with a new “Kia Electric” series slated for launch in 2026, which will be eligible for the 20 % subsidy.

International Repercussions

The policy change has drawn attention from U.S. trade officials, who expressed concern that the increased subsidies might create a “market distortion” that could be considered unfair under U.S. trade law. U.S. Trade Representative Katherine Tai said that “the United States will carefully monitor South Korean subsidy levels to ensure they comply with the rules of the World Trade Organization.” However, Tai also acknowledged that the U.S. has been open to discussing “policy coordination” with allies that share the goal of accelerating the shift to electric mobility.

Meanwhile, European trade bodies have shown interest in South Korea’s approach, viewing it as a possible template for boosting domestic EV adoption without resorting to punitive tariffs. The European Commission’s Department for Mobility and Transport noted that “the Korean subsidy model could provide a useful case study for policymakers seeking to balance industry support with trade compliance.”

What This Means for Consumers

For the average South Korean, the subsidy upgrade translates to lower upfront costs for EVs, potentially making the electric option competitive with internal‑combustion‑engine (ICE) cars. The government also plans to improve charging infrastructure as part of the Green New Deal, which includes building 5,000 new public charging stations by 2026. Together, the subsidy and infrastructure investment aim to create a “closed‑loop” ecosystem that encourages consumers to switch to EVs.

The policy is being monitored closely by industry analysts, who predict that the subsidy increase could push the Korean EV market to a share of 12‑15 % of new‑car sales by 2027, a significant jump from the current 4 %. This rapid growth would not only help South Korea meet its climate targets but also help domestic automakers maintain their global competitiveness in a market that is increasingly defined by battery technology and manufacturing capabilities.

In summary, South Korea’s decision to raise EV subsidies is a calculated response to rising U.S. trade pressure, a strategic move to secure its automotive industry’s future, and a key component of the country’s broader environmental strategy. The policy’s effectiveness will be judged by its ability to sustain domestic EV sales, shield manufacturers from potential tariffs, and keep the country on track to meet its ambitious climate goals.

Read the Full Bloomberg L.P. Article at:

[ https://www.bloomberg.com/news/articles/2025-11-14/south-korea-to-boost-auto-subsidies-to-spur-evs-blunt-us-levies ]