EV Growth May Slow: Reality Check for Electric Vehicle Adoption

The EV Chill: Why Electric Vehicle Growth Might Slow Down in 2024 & Beyond

The electric vehicle (EV) revolution, once seemingly unstoppable, is facing a significant reality check. Bloomberg Green's recent newsletter highlights that the rapid growth trajectory of EVs isn’t guaranteed and anticipates a “bumpy road ahead” for the industry in 2024 and beyond, potentially extending into 2026. While adoption will continue, it won't be the exponential surge many initially predicted, and several converging factors are contributing to this cooling effect.

The core of the issue isn’t a complete rejection of EVs; rather, it's a recalibration of expectations and a shift in consumer behavior influenced by economic pressures, charging infrastructure limitations, and evolving vehicle preferences. The newsletter paints a picture of a market that is maturing beyond early adopters and now confronting challenges related to affordability, practicality, and the sheer complexity of scaling up production and distribution.

Affordability: The Biggest Hurdle

Perhaps the most significant headwind facing EV adoption is price. While battery costs have decreased over time, EVs remain significantly more expensive than comparable internal combustion engine (ICE) vehicles. Government subsidies, a key driver of early EV sales, are being phased out or reduced in many regions. In the US, for example, the Inflation Reduction Act’s stringent sourcing requirements and income caps have effectively excluded a large portion of potential buyers from receiving the full $7,500 tax credit (see details here: [ https://www.irs.gov/credits-deductions/clean-vehicle-credit ]). This price gap is exacerbated by rising interest rates, making financing more expensive and further impacting affordability for a broader consumer base.

The newsletter specifically points to the rise of "affordable" EVs – those priced under $30,000 - as crucial for sustained growth. However, meeting this price point while maintaining profit margins presents a significant challenge for automakers. Tesla’s recent price cuts, while boosting sales volume in the short term, are putting pressure on other manufacturers to follow suit, further squeezing profitability and potentially impacting investment in future EV development.

Charging Infrastructure: A Persistent Bottleneck

The lack of readily available and reliable charging infrastructure remains a major deterrent for potential EV buyers. Range anxiety – the fear of running out of battery power – is still a significant concern, particularly for those living in apartment buildings or rural areas where home charging isn’t an option. While investment in public charging stations is increasing, it's not keeping pace with the growing number of EVs on the road.

The newsletter highlights that many existing chargers are unreliable, often out of order, or too slow to provide a convenient experience. Furthermore, the uneven distribution of charging infrastructure across different regions and socioeconomic areas creates inequities in access to EV ownership. The Biden administration’s National Electric Vehicle Infrastructure (NEVI) program is designed to address this issue, but deploying these chargers effectively faces logistical and bureaucratic hurdles ([ https://www.energy.gov/nevi ]).

Shifting Consumer Preferences & New Vehicle Types

Beyond price and infrastructure, changing consumer preferences are also impacting the EV landscape. The initial excitement surrounding EVs was often driven by a desire for cutting-edge technology and environmental consciousness. However, as the market matures, consumers are increasingly prioritizing factors like practicality, versatility, and overall value.

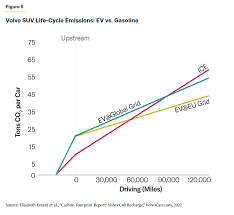

There's growing interest in hybrid vehicles and plug-in hybrids (PHEVs) which offer a compromise between electric range and the convenience of gasoline power. The newsletter notes that automakers are responding to this demand by expanding their offerings in these categories. Furthermore, the popularity of larger SUVs and trucks – traditionally ICE vehicle staples - poses a challenge for EV manufacturers who struggle to produce affordable and efficient all-electric versions. The increased battery size needed for these vehicles further contributes to higher costs.

The China Factor & Global Competition

China's dominance in the EV market adds another layer of complexity. Chinese automakers are rapidly gaining ground globally, offering competitively priced EVs with advanced technology. This intensifies competition and puts pressure on established manufacturers in Europe and North America. The newsletter emphasizes that the global EV supply chain is heavily reliant on China for battery materials and components, creating potential vulnerabilities and geopolitical risks.

Looking Ahead: A More Measured Pace

The Bloomberg Green newsletter doesn't predict the demise of EVs but rather a more measured pace of adoption. While sales will continue to grow, they are unlikely to reach the previously optimistic projections. Automakers need to focus on addressing affordability concerns through battery technology advancements and streamlined production processes. Governments must accelerate investment in charging infrastructure and incentivize EV adoption in underserved communities. Ultimately, the success of the EV revolution hinges on making electric vehicles a truly practical and accessible option for all consumers, not just early adopters. The "bumpy road" ahead requires a more realistic assessment of challenges and a collaborative effort from automakers, governments, and consumers to navigate this evolving landscape.

I hope this article accurately summarizes the key points presented in the Bloomberg Green newsletter. Let me know if you'd like any adjustments or further elaboration on specific aspects!

Read the Full Bloomberg L.P. Article at:

[ https://www.bloomberg.com/news/newsletters/2026-01-06/electric-vehicles-have-a-bumpy-road-ahead-in-2026 ]