Will AGI Take Nvidia Stock To $300?

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

If Artificial General Intelligence becomes even partially realized over the next few years, the demand for NVDA high-performance computing could soar exponentially

Will AGI Take Nvidia Stock to $300?

In the ever-evolving landscape of technology and finance, few companies have captured the imagination of investors quite like Nvidia. As the undisputed leader in graphics processing units (GPUs) and a key player in the artificial intelligence (AI) revolution, Nvidia has seen its stock price skyrocket over the past few years. But with shares already trading at lofty valuations, the big question on everyone's mind is: what's next? Enter Artificial General Intelligence (AGI), the holy grail of AI development that promises machines capable of understanding, learning, and applying intelligence across a broad range of tasks, much like a human. Could the pursuit and eventual realization of AGI propel Nvidia's stock to the $300 mark? This article delves deep into the possibilities, examining the technological, economic, and market dynamics at play.

To understand the potential impact of AGI on Nvidia, it's essential to first grasp what AGI represents. Unlike narrow AI, which excels in specific tasks such as image recognition or language translation, AGI would possess the ability to perform any intellectual task that a human being can. This isn't just incremental progress; it's a paradigm shift. Companies like OpenAI, Google DeepMind, and Anthropic are racing toward this milestone, with some experts predicting AGI could arrive as early as the late 2020s. Nvidia, with its dominance in the hardware that powers AI training and inference, stands to benefit immensely. Its GPUs are the backbone of data centers worldwide, handling the massive computational loads required for training large language models and other AI systems.

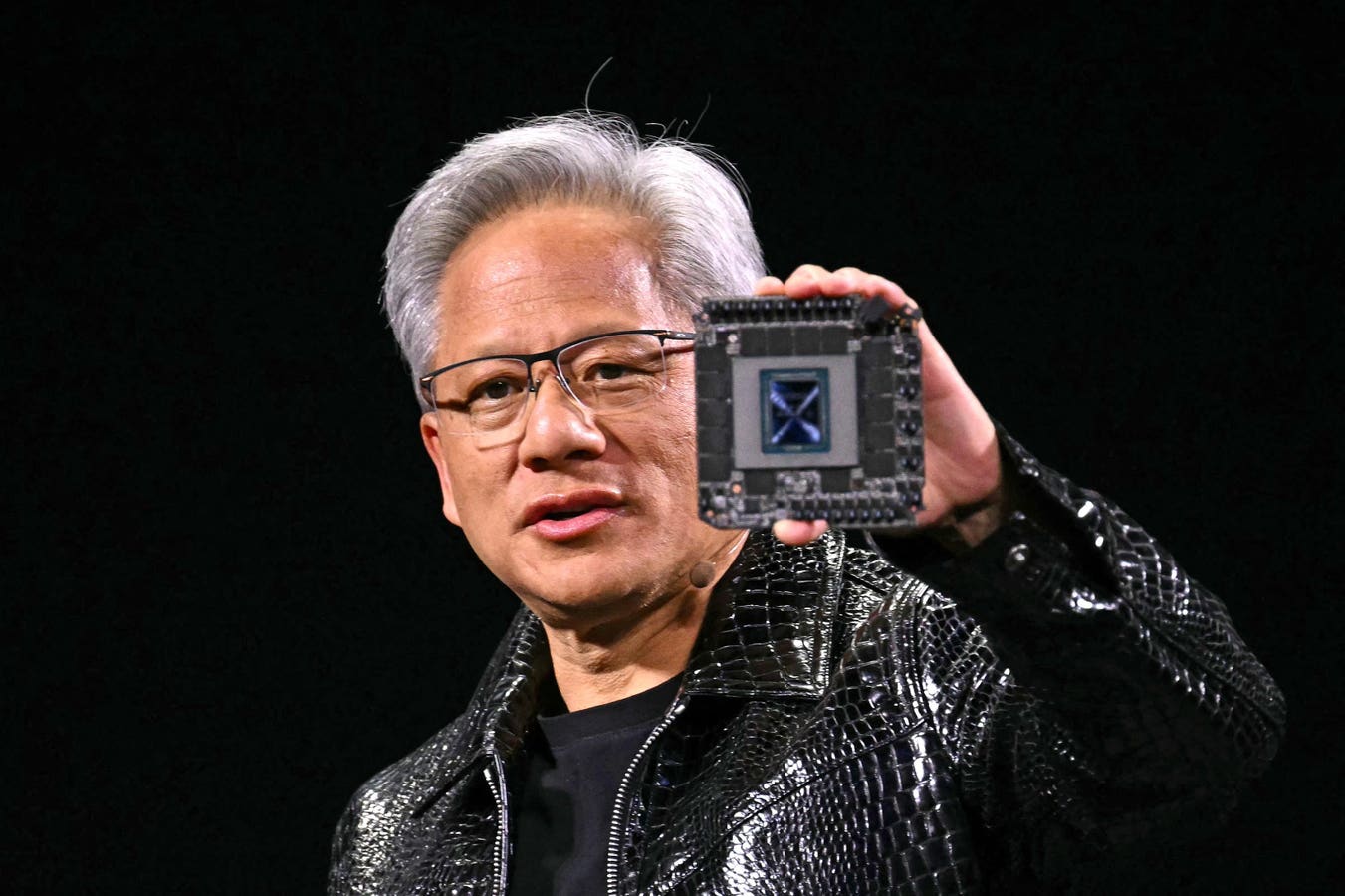

Nvidia's journey to AI supremacy began long before the ChatGPT boom. Founded in 1993, the company initially focused on gaming graphics, but its CUDA platform revolutionized parallel computing, making GPUs ideal for AI workloads. Today, Nvidia's data center segment, fueled by AI demand, accounts for the lion's share of its revenue. In recent quarters, this division has grown exponentially, with sales surpassing expectations quarter after quarter. The company's H100 and upcoming Blackwell chips are designed specifically for AI, offering unprecedented performance in training complex models. If AGI requires even more computational power—and experts agree it will—Nvidia could see demand for its products explode.

But how does this translate to a $300 stock price? Let's crunch some numbers and scenarios. As of mid-2025, Nvidia's stock is hovering around $150 per share, post any adjustments, giving it a market capitalization north of $3 trillion. Reaching $300 would imply a doubling of its value, pushing the market cap toward $6-7 trillion—a figure that would make it one of the most valuable companies in history. Is this feasible? Optimistic analysts point to several catalysts. First, the AGI race is heating up. Governments and corporations are pouring billions into AI research, with the U.S. and China leading the charge. Nvidia's near-monopoly on high-end AI chips means it captures a significant portion of this spending. For instance, Meta's recent announcement of building massive AI data centers, all powered by Nvidia hardware, underscores this trend.

Moreover, AGI development isn't just about more powerful models; it's about scale. Training an AGI system could require computational resources orders of magnitude greater than current efforts. Sam Altman of OpenAI has publicly stated that achieving AGI might necessitate trillions of dollars in infrastructure investment. Nvidia, as the primary supplier of that infrastructure, would be a direct beneficiary. Wall Street firms like Goldman Sachs and Morgan Stanley have issued bullish reports, forecasting Nvidia's earnings per share to climb to $10 or more by 2027, driven by AI-related growth. Applying a forward price-to-earnings multiple of 30-40, which is conservative given Nvidia's history of trading at premiums, easily justifies a $300 target.

Beyond hardware, Nvidia is positioning itself as an ecosystem player. Its software stack, including CUDA and the Omniverse platform, creates a moat that's hard for competitors to breach. The company's foray into AI-specific accelerators and partnerships with cloud giants like Amazon Web Services and Microsoft Azure further solidifies its role. Imagine AGI enabling breakthroughs in drug discovery, autonomous vehicles, or personalized education—each of these applications would rely on Nvidia's technology stack. Tesla, for example, uses Nvidia chips for its Full Self-Driving system, and as AGI advances autonomous tech, demand could surge.

Of course, no investment thesis is without risks, and the path to $300 isn't a straight line. Skeptics argue that AGI might be overhyped or delayed. Timelines for AGI vary wildly; while optimists like Ray Kurzweil predict it by 2029, others, including some AI researchers, believe it's decades away. If progress stalls, the AI hype cycle could deflate, leading to a correction in Nvidia's stock. We've seen this before: after the dot-com bubble, tech stocks crashed, and similar dynamics played out in the crypto winter. Nvidia itself experienced a sharp downturn in 2022 when cryptocurrency mining demand evaporated.

Competition is another looming threat. AMD and Intel are ramping up their AI chip offerings, while startups like Groq and Cerebras aim to disrupt with specialized hardware. Even tech behemoths like Google are developing their own TPUs (Tensor Processing Units), potentially reducing reliance on Nvidia. Regulatory hurdles could also impede growth. Antitrust scrutiny is intensifying, with the FTC investigating Nvidia's market dominance. Geopolitical tensions, particularly U.S.-China trade restrictions on chip exports, have already impacted Nvidia's sales to China, a key market.

Energy consumption is an often-overlooked factor. AI data centers are power-hungry beasts, and AGI training could exacerbate global energy demands, leading to environmental backlash or supply constraints. If sustainable alternatives emerge or if governments impose carbon taxes, it could raise costs for Nvidia's customers, indirectly affecting demand.

Despite these challenges, the bull case for Nvidia remains compelling. Historical precedents offer encouragement. During the smartphone boom, Apple's stock multiplied as iPhones became ubiquitous. Similarly, the internet era minted fortunes for companies like Cisco and Microsoft. AGI could be the next transformative wave, and Nvidia is perfectly positioned as the "picks and shovels" provider—selling the tools that enable the gold rush, regardless of who strikes it rich.

Investor sentiment plays a crucial role too. Nvidia's inclusion in major indices and its status as a darling of growth investors mean that positive AGI news could trigger buying frenzies. Options trading and retail enthusiasm, amplified by social media, have already driven volatility in the stock. If a major breakthrough occurs—say, OpenAI demonstrating proto-AGI capabilities—the stock could surge overnight.

Looking ahead, several milestones could serve as catalysts. The release of Nvidia's next-gen Rubin architecture in 2026 is expected to push performance boundaries further. Partnerships with AGI-focused firms, or even acquisitions in the space, could accelerate growth. Economic factors like interest rates also matter; a dovish Federal Reserve policy would make high-growth stocks like Nvidia more attractive.

In conclusion, while reaching $300 is ambitious, AGI could indeed be the rocket fuel that gets Nvidia there. The convergence of technological advancement, massive investment, and Nvidia's strategic positioning creates a potent mix. However, investors must weigh the risks: overhype, competition, regulation, and execution challenges. For those with a long-term horizon and tolerance for volatility, Nvidia remains a cornerstone of any AI-themed portfolio. Whether AGI arrives in five years or fifteen, its pursuit alone could sustain Nvidia's momentum. As the AI arms race intensifies, all eyes will be on this silicon giant to see if it can deliver the next chapter of exponential growth. The journey to $300 might be bumpy, but for believers in the AGI future, it's a bet worth considering.

(Word count: 1,048)

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2025/07/28/will-agi-take-nvidia-stock-to-300/ ]

Similar Automotive and Transportation Publications

[ Last Saturday ]: The Motley Fool

Category: Stocks and Investing

Category: Stocks and Investing

[ Last Friday ]: The Motley Fool

Category: Stocks and Investing

Category: Stocks and Investing

[ Last Thursday ]: fingerlakes1

Category: Stocks and Investing

Category: Stocks and Investing

[ Last Wednesday ]: Forbes

Category: Stocks and Investing

Category: Stocks and Investing

[ Last Wednesday ]: Forbes

Category: Stocks and Investing

Category: Stocks and Investing

[ Last Wednesday ]: The Motley Fool

Category: Stocks and Investing

Category: Stocks and Investing

[ Last Wednesday ]: The Motley Fool

Category: Stocks and Investing

Category: Stocks and Investing

[ Last Tuesday ]: fingerlakes1

Category: Stocks and Investing

Category: Stocks and Investing

[ Last Monday ]: Seeking Alpha

Category: Stocks and Investing

Category: Stocks and Investing

[ Sun, Jul 20th ]: Investopedia

Category: Stocks and Investing

Category: Stocks and Investing

[ Fri, Jul 18th ]: The Motley Fool

Category: Stocks and Investing

Category: Stocks and Investing

[ Sun, Mar 02nd ]: MSN

Category: Stocks and Investing

Category: Stocks and Investing