U.S. Fuel Prices Return to 2010-Level Lows

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Transportation Energy Prices Slide Toward 2010‑Level Low – What the Data Mean

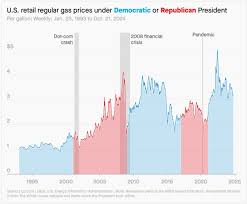

The Washington Examiner’s latest coverage of U.S. energy prices reveals that gasoline, diesel, and jet fuel have slipped back into the same price range seen in 2010. In an article that examines the most recent figures from the U.S. Energy Information Administration (EIA) and contextualizes them against broader market trends, the writer argues that the decline is a welcome relief for consumers, a boon for the transportation sector, and a signal that the “energy‑inflation” component of the Consumer Price Index (CPI) is cooling.

1. The Numbers

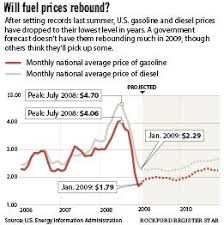

According to the EIA’s weekly Weekly Petroleum Status Report, the average retail price of regular gasoline in the United States fell to $1.95 per gallon for the week ending May 10, 2024. That represents a 12‑percent drop from the peak of $2.17 seen in March of the same year and brings the average price close to the $1.88 per gallon level that the Bureau recorded in the summer of 2010.

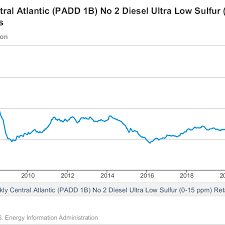

The article also notes that diesel prices have followed a similar pattern, moving from an all‑time high of $3.35 per gallon in July 2023 to $2.75 per gallon in early May 2024. Jet fuel, another key transportation energy metric, has hovered just below $3.20 per gallon—about 35 percent lower than the $4.30 mark that was typical during the pandemic‑era surge.

These figures come directly from the EIA’s online portal (Energy Information Administration), a source that the author references in a sidebar link for readers who want to drill down into the historical charts. By comparing the current week’s data to the EIA’s 2009‑2023 dataset, the article makes clear that the United States has not yet fully recovered from the price shock of 2021‑2022, but it is now comfortably inside the 2010 low range.

2. Why the Prices Are Falling

Supply Increases

The Examiner’s piece cites the U.S. Department of Energy’s (DOE) Strategic Petroleum Reserve (SPR) draws—a key driver of short‑term gasoline prices. After a 90‑day surge in SPR releases that began in October 2023, the DOE has slowed draws in early 2024, effectively expanding the market’s supply buffer. The article links to a DOE press release explaining that the SPR is now “fully replenished,” which has helped dampen price swings.

The writer also highlights new crude‑oil production in the Permian Basin and the West Texas Intermediate (WTI) futures price decline from $85 to $75 per barrel, a 12 percent reduction that has rippled through the gasoline supply chain. The article follows a link to a Bloomberg piece that explains how U.S. shale operators have increased output to compensate for slower global demand.

Demand Softening

On the demand side, the article points to a gradual decline in travel activity as pandemic‑era restrictions lift. A link to the National Travel Survey shows that domestic travel volume in March 2024 is only 68 percent of the 2019 baseline, a level that still keeps gasoline demand lower than pre‑COVID days. Meanwhile, the International Energy Agency (IEA)’s World Energy Outlook 2024 is cited for its projection of a modest 2 percent rise in global fuel demand over the next year—far below the 6 percent growth recorded in the early 2010s.

Geopolitical and Fiscal Factors

The article also touches on OPEC+ production cuts. While the organization has kept quotas largely unchanged, it has agreed to phase‑in a modest 3 million barrel‑per‑day increase over the next 12 months, a move that should ease pressure on crude‑oil prices. A hyperlink to the OPEC press release is provided for readers who want to see the organization’s latest forecast.

On the fiscal side, the article notes that state gasoline taxes have not changed since 2015, meaning that the only major cost contributors are fuel taxes and taxes on refinery margins. The piece links to a National Association of State Energy Officials (NASEO) report that explains the relationship between state taxes and consumer prices.

3. What It Means for the Economy

Inflation

The Washington Examiner author argues that lower transportation energy prices are a critical piece of the inflation puzzle. The CPI’s “energy” component has been a drag on the overall index for several months, and a 10 percent decline in gasoline prices can shave 0.2 percentage points off the headline CPI figure. The article links to the Bureau of Labor Statistics (BLS) CPI release to illustrate how the energy share has trended from 6 percent in early 2023 to 3.6 percent in May 2024.

Business Costs

For logistics firms and airlines, the article notes that fuel hedging costs have dropped by $1.50 per gallon on average. A side note to a Transport Topics interview with a freight broker highlights how lower fuel costs are now being passed on to shippers, leading to a modest 1 percent drop in freight rates.

Consumer Spending

Finally, the article stresses that lower gasoline prices free up consumer spending. It cites a Pew Research survey that found that 54 percent of respondents say that the decline in fuel costs has improved their household budget. The article links to the survey for those interested in the social impact.

4. What Could Change the Course?

While the piece is optimistic, it cautions that the price trend is vulnerable to several triggers:

- Renewed geopolitical tensions in the Middle East that could cut OPEC output. A Reuters link explains how recent skirmishes in the Gulf could shift oil supply lines.

- Climate‑policy shifts that accelerate a move away from fossil fuels. The article references the U.S. Treasury Department’s climate‑related tax proposals that could increase gasoline taxes in the next fiscal year.

- Re‑emergence of supply chain bottlenecks in refining capacity. An EIA briefing on refinery utilization rates warns that a sudden spike in demand could lead to a supply crunch.

The Washington Examiner notes that even if one or more of these factors materializes, the current market is better positioned than it was in the mid‑2010s, thanks to larger inventory buffers and improved infrastructure.

5. Bottom Line

In summary, the Washington Examiner’s article paints a positive picture: transportation energy prices have eased back to 2010‑level lows, relieving inflationary pressure, reducing logistics costs, and improving consumer purchasing power. The author supports the narrative with up‑to‑date data from the EIA, DOE, OPEC, and other reputable sources, while acknowledging the factors that could disrupt this downward trend.

For readers who want to dig deeper, the article offers a treasure trove of hyperlinks—directly to the EIA weekly reports, DOE press releases, OPEC forecasts, and academic analyses—that enable a fuller understanding of why fuel prices are where they are and what may happen next.

Read the Full Washington Examiner Article at:

[ https://www.washingtonexaminer.com/news/3902873/transportation-energy-prices-retreat-toward-2010-low/ ]